Navigating Kenya’s Strengthened Tax Framework: Key Considerations for SMEs

As Kenya’s tax system evolves, Small and Medium Enterprises (SMEs) face mounting challenges in navigating compliance and enforcement measures. The Kenya Revenue Authority (KRA) has sharpened its focus on taxpayer non-compliance, leveraging advanced technology and third-party data to uncover discrepancies. This increasingly vigilant approach necessitates that SMEs proactively adapt their tax management strategies to avoid costly penalties and disruptions.

Here are five critical considerations for SMEs to thrive within Kenya’s strengthened tax framework:

- Proactively Address Potential Inconsistencies

SMEs must ensure that their tax filings are accurate and consistent. KRA’s iTax platform integrates data from suppliers, customers, contractors, banks, and peer companies, enabling it to identify variances with ease. Discrepancies between an SME’s records and those of third parties can prompt audits and investigations. For instance, mismatched VAT claims or inconsistent financial statements may raise red flags. To mitigate this, SMEs should routinely review their records and rectify discrepancies before filing returns.

- Understand Audit Triggers and Prepare Accordingly

Several factors make SMEs vulnerable to KRA audits:

- Chronic Losses: Continuous reporting of losses may lead KRA to question the business model’s viability.

- Tax Refund Claims: Repeated claims for refunds often prompt scrutiny to ensure legitimacy.

- Amended Returns: These can signal prior underreporting or errors, inviting further investigation.

- Voluntary Disclosures: While encouraged, these may prompt audits to verify the completeness of disclosures.

- Significant Financial Transactions: Mergers, acquisitions, or major asset sales attract attention due to potential capital gains tax and stamp duty implications.

- Intelligence Reports: Third-party information from banks, suppliers, whistleblowers, or disgruntled employees can trigger audits.

By recognizing these triggers, SMEs can implement preventive measures, maintain robust records, and ensure compliance.

- Invest in Long-Term Record-Keeping

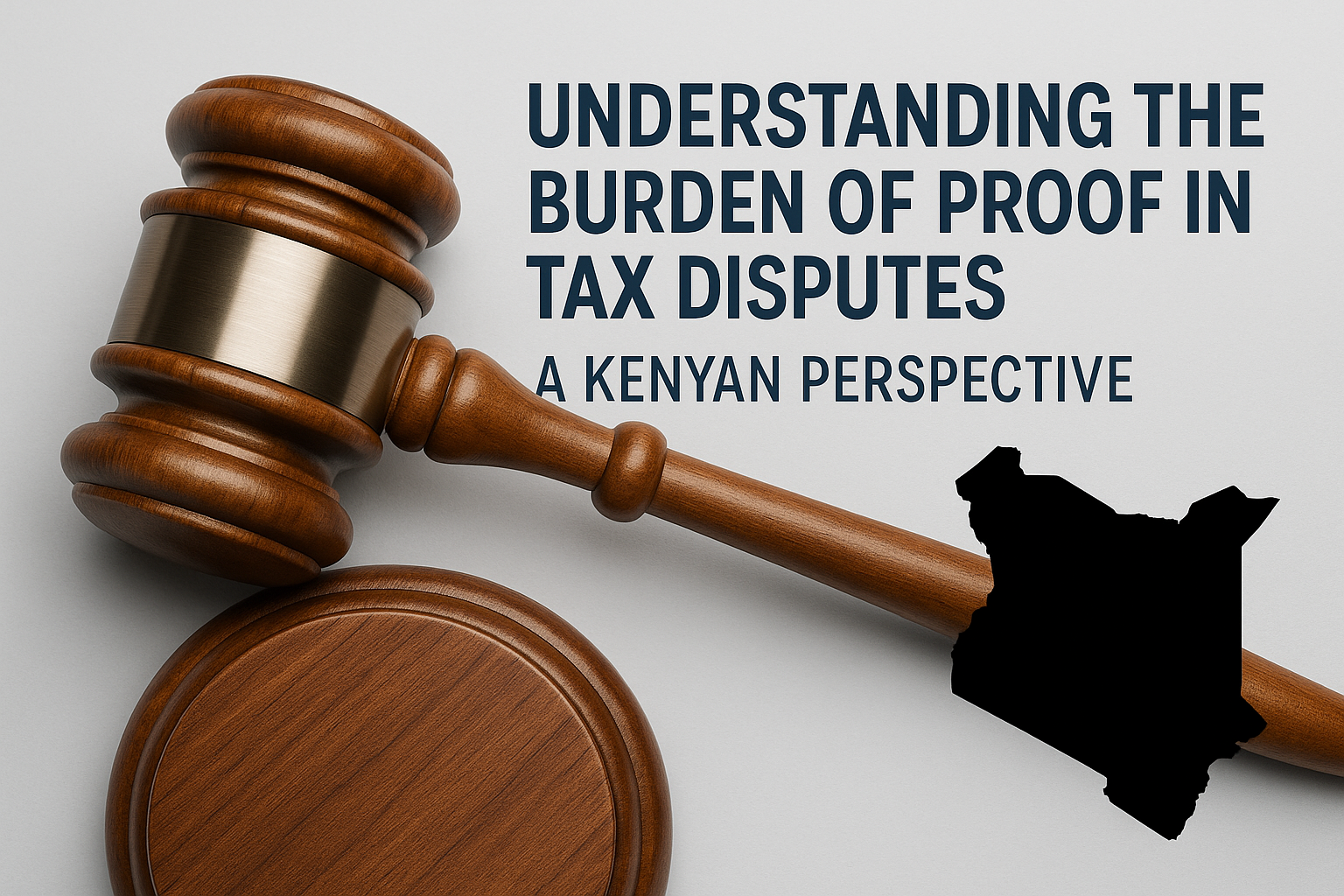

Proper documentation is the cornerstone of tax compliance. The Tax Procedures Act places the burden of proof on taxpayers, requiring them to substantiate their filings when challenged. Recent tribunal decisions suggest that the standard of proof for tax disputes is increasingly stringent, emphasizing the need for meticulous record-keeping.

While the law mandates retaining records for five years, SMEs should consider keeping key documents longer, especially for transactions involving high-value assets or legal disputes. Records such as contracts, invoices, and receipts must be preserved securely to demonstrate compliance if needed.

- Engage in Transparent Communication with KRA

Clear and open communication with the KRA can prevent minor issues from escalating into major disputes. Responding promptly to queries, providing complete information, and clarifying uncertainties demonstrate goodwill and reduce the likelihood of enforcement actions. Conversely, reluctance or delays in communication can be perceived as signs of non-compliance.

- Seek Professional Tax Advice

Navigating Kenya’s complex tax landscape requires expertise. Tax professionals can help SMEs:

- Identify and resolve potential discrepancies.

- Interpret and apply tax laws accurately.

- Prepare for audits by reviewing documentation and identifying weaknesses.

- Develop strategies to address disputes and participate in Alternative Dispute Resolution (ADR) processes, which are often quicker and less adversarial than litigation.

Expert guidance is particularly critical during significant business milestones such as expansions, restructuring, or large financial transactions.

Adapting for Success in a Changing Environment

As SMEs continue to grapple with heightened compliance expectations, prioritizing proactive tax management and leveraging expert support can help mitigate risks. By addressing potential pitfalls, maintaining transparency, and keeping detailed records, SMEs can position themselves for growth and sustainability within Kenya’s evolving tax framework.